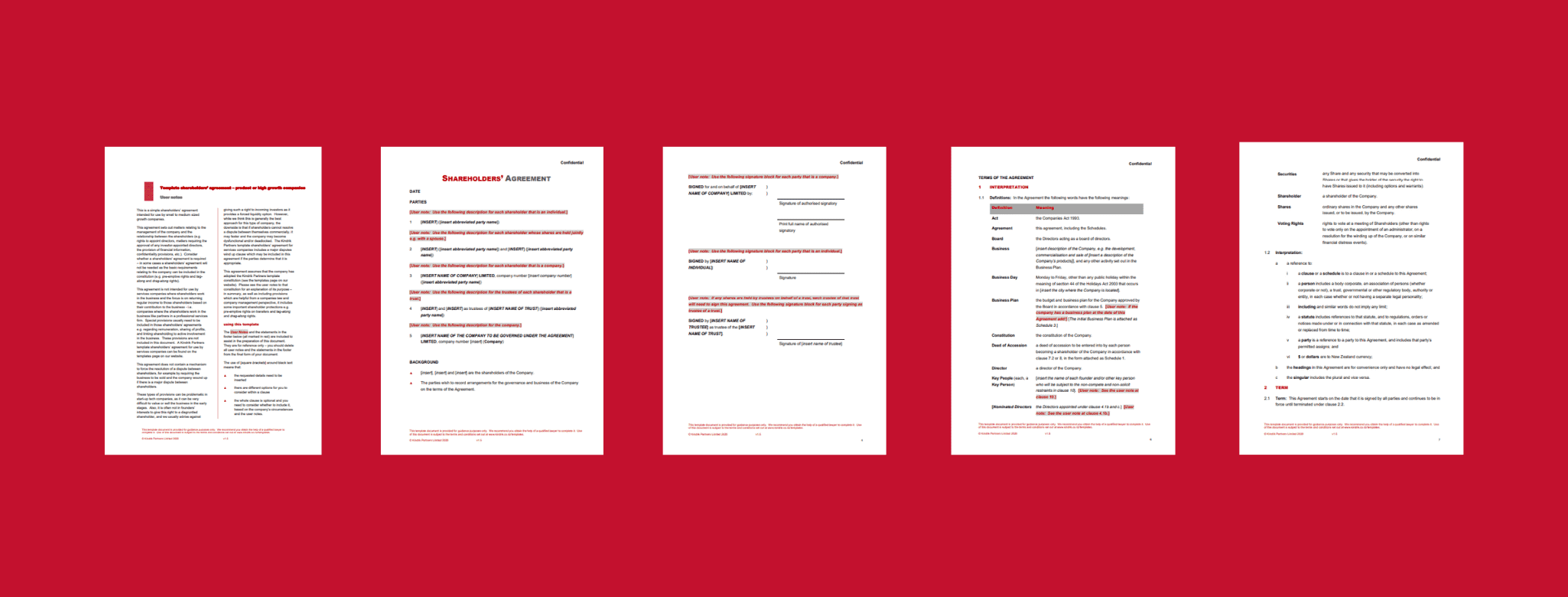

having a say on directors protecting their residential addresses

in a nutshell Submissions are now open for a bill that would allow directors of New Zealand companies to keep their residential addresses private if they have concerns about their…

If so then you may prefer kindrik.sg